Lemonade from Lemonade?

An insurance company recently non-renewed my friend’s home policy because of overhanging trees and a stack of firewood.

Let me start by saying that this is not an outlandish move by an insurance company. Even though I sometimes disagree with decisions, there are important reasons why insurance carriers decide to take actions like this. And the company did give my friend plenty of time to find another carrier.

Language to Impress Investors

Even so, this episode does have me reflecting on the always up-and-coming fintechs because my friend’s home insurance was provided by one such company, called “Lemonade.” These companies are called “insurtech” or “fintech” because they promise to revolutionize the archaic world of insurance and finance with their stunning uses of technology.

Their language to investors usually involves lingo that can take your breath away. Words like “evolve,” “accelerate,” “velocity,” “instantaneous,” “data-driven,” “granular,” and, wait for it, “AI.” After that warm breeze blows through your hair you can open your eyes to see what they’re offering.

The real nub of their proposal in my view is to provide cheap insurance by shifting workflows from paid employees to technology and consumers. In other words, they’re proposing the rough equivalent of the grocery store self-checkout.

Here’s the formula: consumer works with new technology = less employees = less paid humans = reduced cost. That’s the basic theory.

One financial website says that Lemonade, “powered by artificial intelligence . . . will replace brokers and bureaucracy with bots and machine learning.” How? You might ask.

“The Company’s digital substrate enables it to integrate marketing and onboarding with underwriting and claims processing, collecting, and deploying data. . . .”

Whoa there! . . .”digital substrate!” That’ll get a venture capitalist’s heart pumping.

Maybe a good first step to replacing bureaucracy would be to not talk like you were raised by one. (Where’s George Orwell when you need him?)

But in fairness, I don’t know what digital substrate is.

And I can’t accuse them of sounding like a bureaucracy in communicating with consumers.

Chatting with Consumers

Check out the cover page to their home policies here in Oregon.

“You’re Amazing.” So I had to chuckle when Lemonade non-renewed my friend. I guess the bloom is off the rose a bit, and the non-renewal means they think my friend is “not so amazing”?

In strict fairness, they never did say his house was amazing.

But there’s more: “Together, we’ll be able to make insurance an honest, simple and fun experience.”

Setting aside the sense that this sounds a little bit like an invitation from Darth Vader to rule the galaxy–hey, more than one way of “making history”–I do get nervous when companies tell me we’re going to have “fun.”

Unless I’m buying a bounce house, I’m not so sure I want my relationship with a company to be characterized by “fun.” Perhaps something like “pleasant,” “painless,” or “helpful”?

What’s fun about a non-renewal? Come to think of it, what’s fun about insurance?

Insurance is a product we pay good money for hoping that we’ll never use it because, if we do use it, it means something has happened, something from bad to terrible.

Insurance policies use words like “perils,” “theft”, “volcanic eruption,” “fire,” “total loss,” “exclusion,” “damage,” “collision,” “personal injury,” “bodily injury,” or “death and dismemberment.” Are we having fun yet?

I’m imagining a claim call with our Fintech:

Client: I’m texting to open a claim because my house just burned down last night.

AI Claim Bot: Not to worry, together we can make this a fun experience.

(All this is not to say there aren’t some funny things about insurance, but typically they are tragically funny because, well, tragedy.)

Oddly enough, we are having a bit of fun now, so let’s keep this rolling.

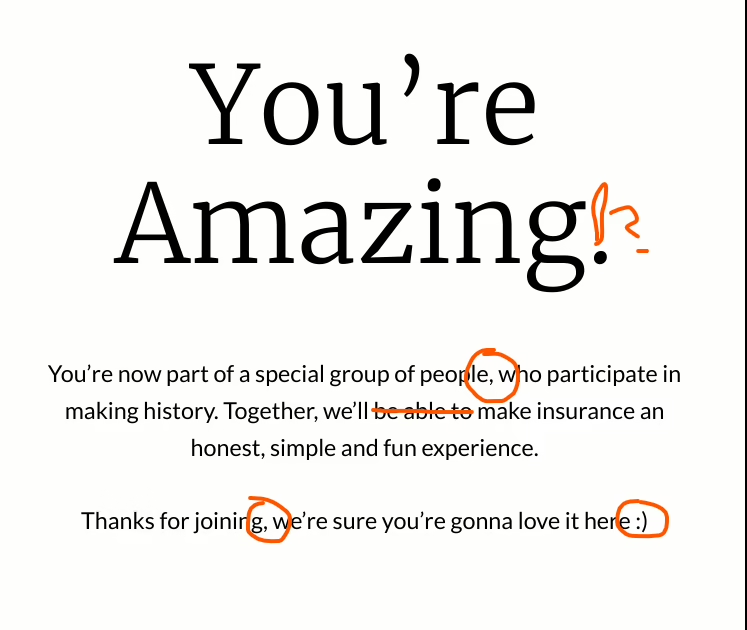

Punctuation

Their punctuation is way off, and I’m not talking about lacking the ballyhooed Oxford comma. Even I noticed it (and some of my highlights are debatable).

On second thought, I guess there are two interpretations here.

Let’s leave aside the less generous reading, that the entire marketing department struggles with punctuation and that the employee forgot to run this by the AI bot.

The more likely take is that they intend the casual style to distance themselves from stodgy insurers. Kind of their way of hanging up the collared shirt and meeting the client in a crisp t-shirt. Not all bad.

Even so, that’s the cover page sent out to customers from, not some local insurance blog (ahem), but from a company valued at a cool $2 billion.

But perhaps this cover page is only on policies in Oregon, where data-driven research–or a stroll through Hillsboro–shows that casual reigns. Maybe it’s well-punctuated for the east coast?

Whatever the case, I do find myself hoping that their policies are properly punctuated because, as Bill Willson argued in When Words Collide, it can matter an awful lot come claim time.

Quoting My Own Home Insurance with a Fintech Bot

Now, to be clear, I’m not against innovation. Fintechs will do some good work and, clearly, many consumers are open to buying their insurance from companies like Lemonade.

I happen to like Lemonade’s effort to make insurance jargon more understandable to consumers. Their giveback program is intriguing though a tad underwhelming considering the valuation. Their website is streamlined and attractive.

In fact, I found their site so inviting that I started the quick quote process for my own home insurance.

Once begun, I was met with a small picture of an attractive woman’s face even though I was communicating with a bot. So I guess they want me to think I’m relating to a human even though I’m not? Oh well, what’s a little duplicity among friends right!?

And anyways, they saved money by employing a picture of a human and that reduces insurance costs.

Did the quote look good!?!?

Their quote? $2500.

My current cost: a bit below $1500.

And good thing I didn’t take their suggestion to “forget everything I know about insurance” because I wouldn’t have known that their coverages were significantly weaker.

In strict fairness, their price did include 355 discounts.

But perhaps that’s only here in Oregon.

Fintech Someday

Perhaps someday these fintech companies will succeed in sinking local independent agencies like ours because of their adventurous training of AI and consumers. Or perhaps they’ll be bought up by a big legacy carrier once they mature. The full developments are well beyond my line of sight.

But for now, maybe a few tweaks are due on the self-checkout; ope, I mean “digital substrate.”

By Eli Plopper Copyright 2025

Learn more About Us (actual people!), our Sensible Approach, or our Carriers.