Standard home insurance excludes damage due to flooding. So what about your house?

A mortgage lender will require you to get flood insurance if you’re in a high-risk flood zone; BUT, if you’re in a medium or low-risk zone, thinking about flood insurance is especially up to you.

So beyond hearing that rain on your roof or seeing a creek nearby, where do you go to find out more about your property?

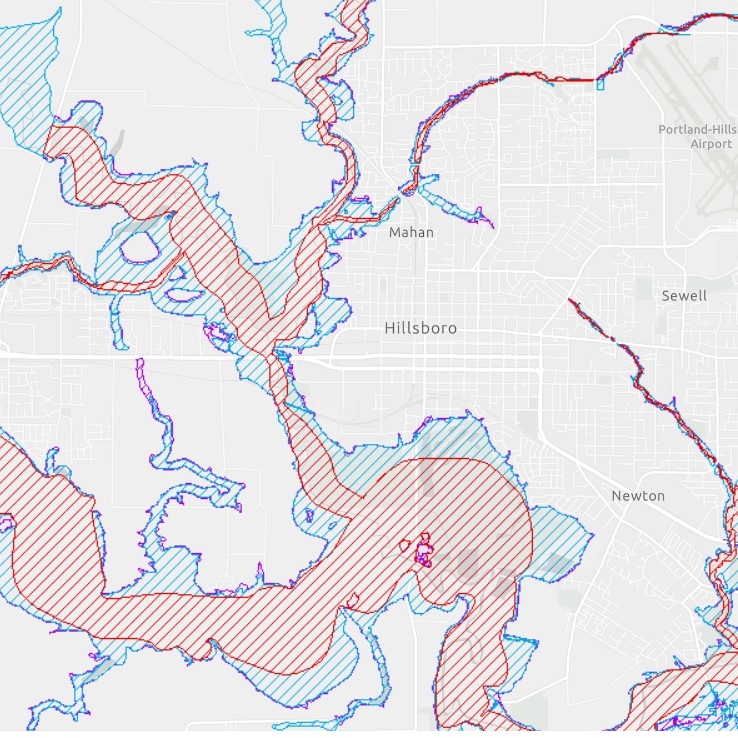

One useful place to begin is Oregon’s Hazard Viewing Tool where you can see the flooding data relevant to your address.

- Click here to go to it.

- Enter your address.

- Open Layers to Display & Check the “Effective FEMA Flood Data” box

- Explore the results

You’ll see three main colors.

Red for the regular floodways. This will be more obvious streams and bodies of waters in your area.

You’ll want to pay extra attention to the blue and purple areas because these show the 100- and 500-year flood plains based on a whole mix of data. Here’s the upshot from the map guide.

If your home is on a blue 100-Year Floodplain, “there is a 26% chance that a “100-year flood” will occur in the next 30 years.”

If your home is on a purple 500-Year Floodplain, “there is a 5-6% chance that a “500-year flood” will occur in the next 30 years.”

Flood insurance itself has undergone a number of changes over the years, especially recently. While flood insurance has been supplied almost exclusively by the National Flood Insurance Program (NFIP) since the late 60s, that has recently begun to change as more private options have become available, but that is a tale for another time.

To delve a bit deeper on terms such as “100-year floodplain,” the US Geological Society has a good introduction.

For more extensive map information, directly from FEMA, you can also enter your address at FEMA Flood Map Service Center | Search By Address, but I honestly find the first one a simpler starting point.

If you’re curious to know more about the insurance side of things, let us know.