This question often comes up when people ask for an auto insurance comparison. After all, car insurance companies offer roadside assistance for only a few bucks a month so why wouldn’t you? (More on that in a minute.)

Many people do choose to include the coverage on their policies and there are some real benefits worth having.

Peace of mind. The number one benefit of having road service on your insurance is simply knowing that if you need a tow or some minimal road service like jumping a battery you can call your insurance carrier. They’ll coordinate a tow with you, and unless you need it towed a long distance or require some extra-special service (say winching from way off the road), the cost will probably be fully covered.

Moreover, if you’re in a household with many drivers, it can be a soothing thought to know ahead of time that there’s a preset number for emergency roadside assistance.

Finally, it can be a simple way of smoothing costs over time. In other words, you pay the company $10 to $30 per year per vehicle and, in exchange, they’ll help coordinate assistance and pay to tow your car if your car needs roadside assistance. Yes, you are paying every year for the coverage, but you don’t need to worry about getting hit with a $150 tow bill.

From my experience as an insurance agent for over a decade, most people are happy to have the coverage on their insurance and are happy with the relatively easy process of requesting a tow.

Not bad. And for only a few dollars a month!

So why wouldn’t you get it?

There are two main reasons you might not want ERS on your insurance.

First, you might not want it if you’re the type of person who would rather keep your money and then pay out of pocket if you do need road service.

The advantage here is pretty simple and immediate. You reduce your car insurance bill some and don’t have to pay the insurance company any money for the coverage.

If you need road service, you know you’re fully on the hook. The cost will likely be $75 to $200 depending on your situation.

And if you don’t need to use emergency road assistance, you keep your money.

That’s one reason many people feel comfortable just planning to coordinate and cover emergency road assistance if needed.

Second, you might want to minimize activity on your insurance. This is because roadside assistance claims through your insurance will likely increase your insurance rates. Not a lot, but some.

Not to worry. Companies certainly don’t weigh roadside assistance claims like an at-fault accident or even like a simple glass claim. But it is important to know that roadside assistance claims are usually weighed by an insurers rating systems. And if you go shopping for insurance, it will likely affect the quotes provided by other carriers as well. Again, not a lot, but some (I’d be more specific if I could, but each carrier is different!). Like it or not, it is activity on your insurance.

On its own, one tow–or even two- won’t make a big difference. It’s not worth losing sleep over.

But if you happen to also have more driving history in your household, say a few fender benders and a ticket or two, that towing request could combine with your other history in a way that really increases your costs or even leads to non-renewal. This is rare, but I’m pretty sure I’ve seen it happen over the years.

Ooffff, but what do I do if I don’t have roadside assistance and my car breaks down?

Awhile back, our aged–and beloved–family van broke down in Beaverton. I thought, “Dang, I should’ve bought that coverage on my insurance!” But, it turned out to be pretty simple.

That’s because we have something called a smartphone!

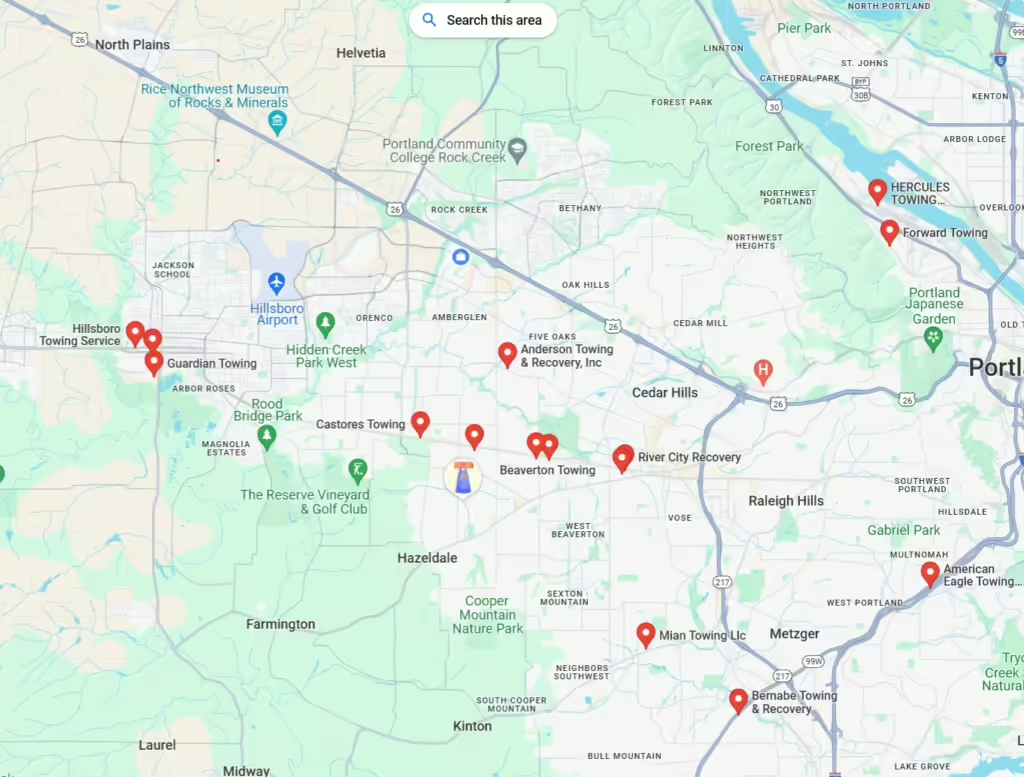

I searched “towing” on my mapping app and within three calls I had a local gentleman say, “I can be there in 15 minutes.” Sure enough, he arrived quickly, towed the van a couple miles to the repair shop in Tigard, and charged me $80. Done.

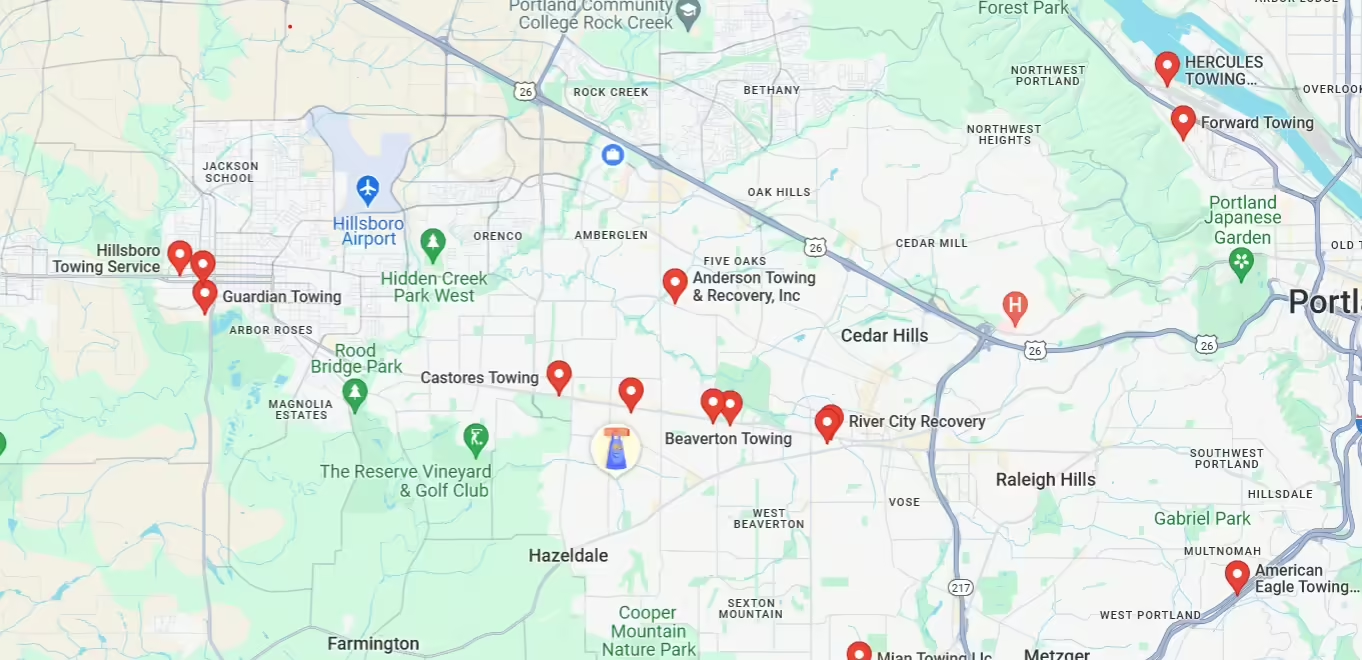

A quick map search in the Hillsboro area like the one above shows there are many options. Moreover, many repair shops and dealerships offer their own local towing if the car is being towed to them.

The point is: you have options.

The process is actually not too different than if you use your insurer. You pick up your smartphone and call someone; though, you may spend a tad more time checking reviews of towing companies.

One advantage of finding your own tow is that you’re talking directly with a local and regional provider. This matters because the local provider has a more immediate sense of the wait times, the capabilities, and the area you are in.

If you were to call your insurer or even a special roadside assistance provider, you’ll likely go into a queue waiting for a tow truck within their network of providers. The towing company will contact you to arrange the tow timing, and you should be all set.

A Few Less-Known Facts about Roadside Assistance

First, you may already know this, but insurance carriers do not provide their own towing services. Instead, they farm out tow claims to massive national networks that specializes in connecting tow companies and customers. (The towing companies in these networks have agreed to certain rates and standards of service.)

Second, many insurers still allow you to use their service to coordinate a tow even if you don’t have the coverage on your policy. All the billing and charges will go directly to you instead of the insurer.

Third, some credit cards provide a roadside assistance number to help coordinate a tow and sometimes at a set rate.

Finally, you can coordinate your own tow without involving your insurance and, if you do have the coverage on your insurance, you can usually request reimbursement.

What about subscribing to emergency roadside service through special providers?

If you really are worried about emergency road service and like the idea of having travel perks and other benefits, it might be worth investigating one of the subscription services below.

AAA is probably the most well-known.

Good Sam is popular for RVs.

A more recent newcomer, the Better World Club specializes in EVs, hybrids and bicycles–and promises carbon neutrality.

Hagerty Drivers Club is more common for classic cars.

Many of these services also serve as affinity marketing programs into insurance carriers. AARP has one connected to Allstate. AAA has its network of insurers. Haggerty does. And so does Good Sams.

Like any service, it’s important that you look through the benefits and limitations to see if the package is something you want to pay for.

If you’re here in Oregon, we’d love to provide a car and home insurance comparison for you.

Learn more About Us (actual people!) and our Sensible Approach to insurance.